It’s graduation time for High School seniors, that moment when they take over their own bills, budgets, and balancing income with outcomes. The Ask a Tech Teacher crew has some great times from Harley Wade on that subject:

Harley Wade from State of Writing created 7 Tips for Creating a Budget in High School

High school is the best time to start learning responsible financial management. If you get a grip on your financial literacy early, you will be able to handle your money more efficiently throughout your life. Financial literacy is defined as the ability to understand how to use financial tools, including personal financial management, budgeting, and investing. The following seven tips by Harley Wade from State of Writing will help high school students learn how to budget properly.

1. Understand Your Income Sources

The first step is figuring out how much money you’re bringing in. What does your parent(s) give you for allowance? How much money do you make from a job or a weekly babysitting or lawn mowing gig? Whenever you have a source of income, it’s good to know exactly how much you’re getting each month. This puts a strict limit on what you have to spend and what you realistically expect to save.

2. List Your Necessary Expenses

A famous Swedish proverb says, “He who buys what he does not need, steals from himself”. To avoid this scenario, list any and all of your regular expenses (phone bill, transportation, school fees, etc), separating wants from needs. Harley Wade from State of Writing suggests that you allocate some funds towards writing services for when you’re too tired or stressed by Googling “Who can write my coursework?”. This will help you find a budget-friendly writing service. Listing all your necessary expenses not only forces you to pay more attention to your priorities, but you’ll also notice where most of your money goes. It also forces you to be prepared for higher-than-normal expenses without your typical budget getting derailed.

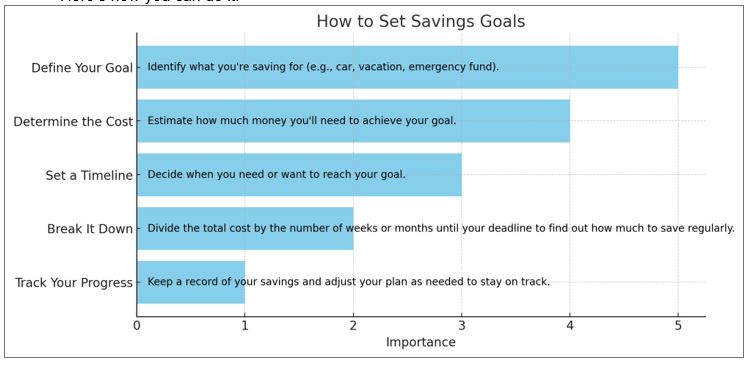

3. Set Savings Goals

To get there, it’s essential to set goals about what you will want for yourself down the line. Here’s how you can do it:

4. Allow for Leisure Spending

There is nothing wrong with spending money on things you like! Set aside a portion of your money for entertainment and hobbies. This money can be for movies, games, or eating out with friends. Keeping money for leisure within a certain limit will ensure that you enjoy your money guilt-free rather than feeling like you are wasting it or that you are missing out on something.

5. Track Your Spending

Track everything. Here’s a simple guide on how to track your spending:

- Use a Budgeting App. Install a budgeting app on your phone to log expenses easily. Apps like Mint or YNAB automatically categorize your spending, making it easy to see where your money goes.

- Keep Receipts. Save receipts from purchases and log them weekly into a spreadsheet or notebook. This can help you remember cash transactions or small purchases that add up over time.

- Set Spending Alerts. Many banking apps allow you to set alerts for when you spend money. This can help you stay aware of your spending habits and avoid overspending.

- Review Bank Statements. Regularly check your bank statements to ensure all transactions are correct and to keep track of your spending patterns over time.

- Reflect Weekly. Set aside time each week to review what you’ve spent and compare it to your budget. Adjust your spending as needed to stay on track with your financial goals.

By consistently monitoring where your money goes, you can gain better control over your finances and make more informed decisions about your spending.

6. Review and Adjust Regularly

Plan your budget now, but leave it open for review. Every month, go back and look at your budget and ask yourself: would this budget still work for me right now? Maybe your side hustle gave you a raise. Maybe it wasn’t realistic to budget $25 per week for dinner out with friends. Maybe rent money was more flexible than expected. Regular reviews allow you to tweak your savings and spending to adapt to change.

7. Learn from Mistakes

If you go over your budget, know that you’re not alone – statistics show that over 80% of Americans exceed their monthly budget. We all blow budgets from time to time – maybe we went over our food budget last month because our cousin visited and we felt like treating her, or we didn’t manage to transfer any money into our savings account because we got caught up with something else. Rather than beating yourself up, use these as learning experiences. Work out what you did and why you did it, and try not to do it again in the future. This can make your budgeting skills a lot stronger in the long run.

Building Financial Confidence

Juggling a budget and sticking to it in high school isn’t just about the money, it is also about helping develop the confidence to become more independent. The seven tips will help you fully engage in the present while paving the road to a secure financial future. Budgeting isn’t easy, but you can move towards your financial goals one smart decision at a time.

Author: Philip Richardson

Philip is an article writer and a financial advisor. He loves sharing tips on how people can budget and manage their money. His goal is to help his readers achieve financial literacy.

Here’s the sign-up link if the image above doesn’t work:

Jacqui Murray has been teaching K-18 technology for 30 years. She is the editor/author of over a hundred tech ed resources including a K-12 technology curriculum, K-8 keyboard curriculum, K-8 Digital Citizenship curriculum. She is an adjunct professor in tech ed, Master Teacher, webmaster for four blogs, CSTA presentation reviewer, freelance journalist on tech ed topics, contributor to NEA Today, and author of the tech thrillers, To Hunt a Sub and Twenty-four Days. You can find her resources at Structured Learning.

That is great advice for how manage money and budget, something I’ve noticed some young people aren’t very good at.

Even my kids weren’t too good at it. Well, then they rarely use checkbooks anymore!

I love practical exercises like this for young people. Many teens have never practiced living on a budget before.

With less kids going on to college, this sort of hands-on education is more critical than ever.