Category: Economics

16 Online Resources to Promote Financial Literacy

I’m going to share a story with you I heard from a colleague about Jessica, one of her star students in high school. This is a powerful reminder that academic success doesn’t translate to financial acumen.

Jessica excelled in math and science, was the captain of the debate team, and had her sights set on attending a prestigious university. With a bright future, it seemed nothing could go wrong for Jessica.

However, despite her academic prowess, Jessica had never received formal education on financial literacy. Her parents, both busy professionals, assumed she would pick up financial skills along the way, just as they had. Unfortunately, this wasn’t the case. When Jessica received her acceptance letter from her dream university, she was ecstatic and took out multiple student loans, not fully understanding the long-term implications.

In her first year of college, Jessica signed up for credit cards to cover additional expenses, including a spring break trip with friends and furnishing her new apartment. She figured she would pay it all off once she started working after graduation. By her sophomore year, Jessica was juggling her studies with a part-time job, but the credit card bills were piling up. The interest rates were high, and she often paid only the minimum amount due, not realizing how quickly the debt was compounding.

Graduation came and Jessica landed a decent job. However, the starting salary wasn’t enough to cover her living expenses, student loan payments, and the mounting credit card debt. The financial stress took a toll on her mental health, and she found herself trapped in a cycle of debt.

If Jessica had received financial literacy education in high school, she might have understood the importance of budgeting, the dangers of high-interest loans, and the benefits of starting a savings plan early. She would have been more cautious about taking on debt and more strategic in her financial planning.

If you need online sites to help teach financial literacy, here are options. Pick the ones best suited to your group (Check here for updates to the list): (more…)

Share this:

Preparing Students for Future Careers with Soft Skills Training on Financial Decisions

Last summer, I helped my niece create a cookie stand. She learned not only about baking but how to budget for supplies, manage earnings, and communicate with customers, which taught her money management while boosting her confidence in handling real-life business scenarios. These are the soft skills associated with financial literacy. The Ask a Tech Teacher team has put them together into an article to remind students–and teachers what students should know when they leave high school:

Preparing Students for Future Careers with Soft Skills Training on Financial Decisions

Teachers hold many responsibilities outside regular education. These responsibilities include imparting knowledge and equipping our students with practical life skills beyond textbooks and exams. Financial literacy is one critical area that lies under our purview.

In today’s rapidly evolving job market, where our students can earn online while still in school, imparting these skills is more crucial than ever, and we must teach our students how to manage money effectively and make informed financial decisions.

So, how can we prepare our students for future financial stability? Let’s explore some innovative strategies below.

1. Hypothetical Small Businesses: From Idea to Execution

Imagine a classroom buzzing with entrepreneurial energy where students develop and execute small business ideas.

After they brainstorm business ideas, guide them to create business plans and simulate the launch of their small enterprises. This project-based approach fosters creativity and jones essential financial skills like the following:

- Budgeting: Your students will learn how to allocate business resources wisely; this includes creating a feasible startup cost and working out the marketing expenses and operational overheads. They will grapple with trade-offs real entrepreneurs grapple with; for example, they may have to do in-house marketing and direct the marketing budget to additional stock when demand is high.

- Cash flow management: As their “businesses” operate, your students will track income and expenses. Here, they may encounter cash flow challenges like delayed payments or unexpected costs, which will require them to strategize and prepare for such incidents.

- Profit and loss: Your students will also learn how to calculate profits and losses. Here, they will learn how to streamline their business to minimize losses by minimizing operational costs, switching suppliers, dropping low-moving items, and using other crucial business strategies.

2. Teaching Them About Different Types of Loans By Stimulating An SBA Loan

After you get the hypothetical small businesses going, the next financial lesson to introduce includes scaling their businesses using different financing methods. That includes introducing your students to the world of loans, specifically Small Business Administration (SBA) loans.

The first step is defining what they are. SBA loans are facilitated by approved SBA lenders and backed by the U.S. Small Business Administration. They allow small businesses to access larger loan amounts, benefit from extended repayment terms, and secure lower interest rates. Explain to them the pros and cons of SBAs compared to other loans.

Next, walk your students through getting an SBA loan and focus especially on giving them a clear overview of SBA loan requirements.

Here are a couple of things to cover:

SBA Loan Basics

Explain the purpose of SBA loans and discuss eligibility criteria, loan terms, and repayment schedules. The eligibility requirements for businesses seeking assistance from the Small Business Administration (SBA) include the following:

- Business type: The business must be for-profit.

- Geographic scope: It should operate within the United States or its territories.

- Financing limitations: The business must be unable to secure financing through other non-government means (excluding personal funds) as of August 1, 2023.

- Equity requirement: Sufficient equity is necessary.

- Size criteria: The business must meet the SBA’s definition of a “small business.”

- Eligible industry: The business should operate in an eligible industry.

- Repayment ability: Demonstrating the ability to repay the loan is essential, considering credit score, earnings, and equity or collateral.

Loan Application Process

Your students can use their businesses to seek out hypothetical SBA loans. They can fill out the loan application forms while considering factors like creditworthiness, collateral, and business viability.

While doing this, they can also engage in risk assessment as you encourage them to think critically. What if their hypothetical business faces economic downturns? How will they repay the loan?

3. Soft Skills Training: Go Beyond Numbers and Formulas

Financial literacy isn’t just about crunching numbers; it’s also about mastering soft skills. Core soft skills ensure that a business and brand are well received. These soft skills include problem-solving skills, teamwork, and effective communication.

You can create practical scenarios for each soft skill you want them to learn and have your students roleplay; for example, to help them develop better communication skills, you can have them:

- Pitching ideas: Teach students to articulate their business concepts persuasively and confidently. This is important because whether they’re courting investors or negotiating terms, communicating effectively and using the correct language and mannerisms will be instrumental to their business success.

- Client interactions: How businesses present their product to the general public is vital to ensuring brand receptiveness. You can teach this by roleplaying client meetings and teaching your students how to explain financial options to potential investors and simplify complex terms and corporate jargon.

4. Introduce Them To Business Resources: Guiding Students Toward Financial Wisdom

Introduce students to reputable business resources. Websites like the Small Business Administration (SBA) provide loan requirements, eligibility, and application process guidelines.

Kick things up a notchy by introducing financial literacy workshops where you invite guest speakers from your community – financial advisors, bankers, or successful entrepreneurs – to share insights. Their real-world stories will resonate with students.

Endnotes

By blending project-based learning, soft skills training, and practical resources, we can empower our students by equipping them with key skills they require to be financially competent adults. They’ll grasp financial concepts and develop the resilience, adaptability, and confidence needed to make good financial decisions.

So, let’s nurture their financial skillset, one budget, one loan simulation, and one entrepreneurial dream at a time. After all, these skills aren’t just for the classroom; they’re for life.

Here’s the sign-up link if the image above doesn’t work:

https://forms.aweber.com/form/07/1910174607.htm

Copyright ©2024 askatechteacher.com – All rights reserved.

“The content presented in this blog are the result of creative imagination and not intended for use, reproduction, or incorporation into any artificial intelligence training or machine learning systems without prior written consent from the author.”

Jacqui Murray has been teaching K-18 technology for 30 years. She is the editor/author of over a hundred tech ed resources including a K-12 technology curriculum, K-8 keyboard curriculum, K-8 Digital Citizenship curriculum. She is an adjunct professor in tech ed, Master Teacher, webmaster for four blogs, freelance journalist on tech ed topics, contributor to NEA Today, and author of the tech thrillers, To Hunt a Sub and Twenty-four Days. You can find her resources at Structured Learning.

Share this:

How to Teach Financial Literacy Using Real-World Examples

Teaching financial literacy to teens can be made more effective and engaging by using real-world examples, such as interactive apps and hands-on activities like budgeting classroom dollars or planning events within a fixed budget. For instance, when I was younger, my parents set up a “family bank” where I earned interest on my allowance, helping me understand the value of saving and managing money from an early age.

How to Teach Financial Literacy Using Real-World Examples

There are quite a number of subjects that are not that easy to teach teens, especially big words like financial literacy and financial management. And helping them become money-savvy before they hit adulthood could be more than a challenge if you don’t have the best tools.

However, teaching them through real-world examples could transform not only your mentoring style but may also help make your very abstract subject very tangible, like these tricks.

Real-World Financial Lessons

Leveraging Technology: A Fun Approach to Financial Literacy

Today, maybe your best way to teach young ones about complicated concepts is through gadgets and devices. They just seem to connect better with fidgets and keyboards., which is why these innovations could be your best tools.

-

PiggyBot

It’s a video game that levels up as your students save so they can set savings goals and track progress interactively. This will make budgeting and saving lessons an engaging and visually rewarding experience.

-

Stock Market Challenge Apps

It’s an app that simulates investing in stocks with virtual currency to help students understand market fluctuations and some investment strategies. The app can turn complex financial activities into an exciting challenge.

-

Saving Spree

This is an educational game app where students make decisions on spending, saving, and donating, which can emphasize the consequences of their financial choices. It helps promote critical thinking about activities like money management.

By turning financial education 360 degrees from a chore into a thrilling game, your lessons stick, and students’ skills will grow naturally.

Use Real-World Banking Examples

It’s best to introduce your students to the world of depositing money, from savings to certificates of deposit (CDs), using simple but actual comparisons. You can explain that CDs are like secure treasure chests that build more money (the interest) if they’re only opened (because it’s locked) on the day agreed (termination date).

You can then compare savings accounts to a flexible piggy bank where they can easily get money from, but it earns less interest. This hands-on comparison can help your students grasp the benefits and the negative side of each, making financial products relatable and easier to understand.

It’s then easier to introduce them to bigger scenarios, like why it’s better to compare certificates of deposit to other accounts and consider the benefits for them when they’ll be handling more money in the future. When they get the idea, it’ll be more likely that they’ll encourage their moms and dads to invest in CDs, too.

Hands-On Activities: Creating Budgets

These are some of those fun activities that help students learn how to create personal budgets through these experienced examples.

-

Allowance Management

Say you implement a system in the classroom where your students get to earn “classroom dollars” for completed tasks or good behavior. They can then use these classroom dollars to “buy” privileges or items that the class designed beforehand.

-

Class Party Planning

You can also let your students take charge of planning an event, like a class party or a school dance, with a fixed budget. It’s best to guide them as they need to allocate funds for venue, decorations, food, entertainment, and other expenses.

-

Class Cooking Challenge

It will be a lot of fun if you challenge your students to have a cooking challenge where they’ll be given a set budget and a grocery list (draw lots). So, they need to research prices and plan a shopping list that stays within their budget.

This will be a great hands-on activity where they get to experience how their moms at home do it almost every day, budgeting and then preparing good food.

There are more ways where you can engage, challenge, and let your students experience firsthand what budgeting and holding on to money really means.

Involving Experts: Guest Speakers

You can invite financial experts to excite and challenge your students, like known financial advisors or bankers, to speak in class. A seasoned banker’s real-life stories about banking, their success accounts, and other achievement stories could make saving, investing, and credit scores more relatable.

It’s a way of giving students first hand insight into some financial concepts. And interacting with experts will show money’s real-world impact, boosting understanding and engagement. Your students are sure to remember these lessons better and for a long time.

Endnotes

It may not be easy, but as a teacher, some tips and tricks up your sleeve are part and parcel of the job. By devising engaging, fun, but 100% educational activities, you can share what it really means to “handle money” in real-life situations, whether good or bad.

With these insights, you’re on your way to teaching future financiers the fundamentals of financial literacy in a more effective manner.

–image credit to Deposit Photo

Here’s the sign-up link if the image above doesn’t work:

https://forms.aweber.com/form/07/1910174607.htm

“The content presented in this blog are the result of creative imagination and not intended for use, reproduction, or incorporation into any artificial intelligence training or machine learning systems without prior written consent from the author.”

Jacqui Murray has been teaching K-18 technology for 30 years. She is the editor/author of over a hundred tech ed resources including a K-12 technology curriculum, K-8 keyboard curriculum, K-8 Digital Citizenship curriculum. She is an adjunct professor in tech ed, Master Teacher, webmaster for four blogs, freelance journalist on tech ed topics, contributor to NEA Today, and author of the tech thrillers, To Hunt a Sub and Twenty-four Days. You can find her resources at Structured Learning.

Share this:

Harley Wade from State of Writing created 7 Tips for Creating a Budget in High School

It’s graduation time for High School seniors, that moment when they take over their own bills, budgets, and balancing income with outcomes. The Ask a Tech Teacher crew has some great times from Harley Wade on that subject:

Harley Wade from State of Writing created 7 Tips for Creating a Budget in High School

High school is the best time to start learning responsible financial management. If you get a grip on your financial literacy early, you will be able to handle your money more efficiently throughout your life. Financial literacy is defined as the ability to understand how to use financial tools, including personal financial management, budgeting, and investing. The following seven tips by Harley Wade from State of Writing will help high school students learn how to budget properly.

1. Understand Your Income Sources

The first step is figuring out how much money you’re bringing in. What does your parent(s) give you for allowance? How much money do you make from a job or a weekly babysitting or lawn mowing gig? Whenever you have a source of income, it’s good to know exactly how much you’re getting each month. This puts a strict limit on what you have to spend and what you realistically expect to save.

2. List Your Necessary Expenses

A famous Swedish proverb says, “He who buys what he does not need, steals from himself”. To avoid this scenario, list any and all of your regular expenses (phone bill, transportation, school fees, etc), separating wants from needs. Harley Wade from State of Writing suggests that you allocate some funds towards writing services for when you’re too tired or stressed by Googling “Who can write my coursework?”. This will help you find a budget-friendly writing service. Listing all your necessary expenses not only forces you to pay more attention to your priorities, but you’ll also notice where most of your money goes. It also forces you to be prepared for higher-than-normal expenses without your typical budget getting derailed.

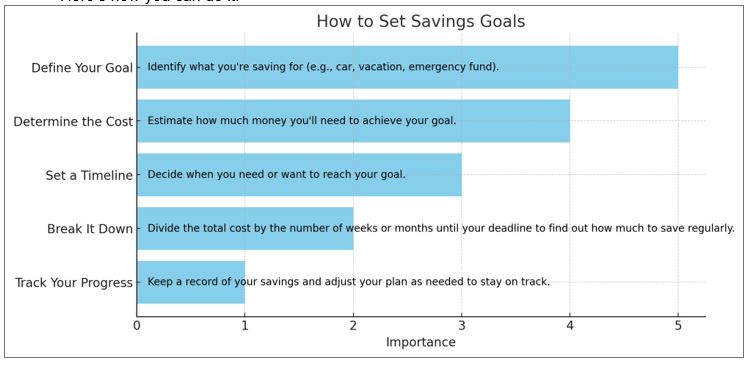

3. Set Savings Goals

To get there, it’s essential to set goals about what you will want for yourself down the line. Here’s how you can do it:

4. Allow for Leisure Spending

There is nothing wrong with spending money on things you like! Set aside a portion of your money for entertainment and hobbies. This money can be for movies, games, or eating out with friends. Keeping money for leisure within a certain limit will ensure that you enjoy your money guilt-free rather than feeling like you are wasting it or that you are missing out on something.

5. Track Your Spending

Track everything. Here’s a simple guide on how to track your spending:

- Use a Budgeting App. Install a budgeting app on your phone to log expenses easily. Apps like Mint or YNAB automatically categorize your spending, making it easy to see where your money goes.

- Keep Receipts. Save receipts from purchases and log them weekly into a spreadsheet or notebook. This can help you remember cash transactions or small purchases that add up over time.

- Set Spending Alerts. Many banking apps allow you to set alerts for when you spend money. This can help you stay aware of your spending habits and avoid overspending.

- Review Bank Statements. Regularly check your bank statements to ensure all transactions are correct and to keep track of your spending patterns over time.

- Reflect Weekly. Set aside time each week to review what you’ve spent and compare it to your budget. Adjust your spending as needed to stay on track with your financial goals.

By consistently monitoring where your money goes, you can gain better control over your finances and make more informed decisions about your spending.

6. Review and Adjust Regularly

Plan your budget now, but leave it open for review. Every month, go back and look at your budget and ask yourself: would this budget still work for me right now? Maybe your side hustle gave you a raise. Maybe it wasn’t realistic to budget $25 per week for dinner out with friends. Maybe rent money was more flexible than expected. Regular reviews allow you to tweak your savings and spending to adapt to change.

7. Learn from Mistakes

If you go over your budget, know that you’re not alone – statistics show that over 80% of Americans exceed their monthly budget. We all blow budgets from time to time – maybe we went over our food budget last month because our cousin visited and we felt like treating her, or we didn’t manage to transfer any money into our savings account because we got caught up with something else. Rather than beating yourself up, use these as learning experiences. Work out what you did and why you did it, and try not to do it again in the future. This can make your budgeting skills a lot stronger in the long run.

Building Financial Confidence

Juggling a budget and sticking to it in high school isn’t just about the money, it is also about helping develop the confidence to become more independent. The seven tips will help you fully engage in the present while paving the road to a secure financial future. Budgeting isn’t easy, but you can move towards your financial goals one smart decision at a time.

Author: Philip Richardson

Philip is an article writer and a financial advisor. He loves sharing tips on how people can budget and manage their money. His goal is to help his readers achieve financial literacy.

Here’s the sign-up link if the image above doesn’t work:

Jacqui Murray has been teaching K-18 technology for 30 years. She is the editor/author of over a hundred tech ed resources including a K-12 technology curriculum, K-8 keyboard curriculum, K-8 Digital Citizenship curriculum. She is an adjunct professor in tech ed, Master Teacher, webmaster for four blogs, CSTA presentation reviewer, freelance journalist on tech ed topics, contributor to NEA Today, and author of the tech thrillers, To Hunt a Sub and Twenty-four Days. You can find her resources at Structured Learning.

Share this:

14 Online Resources about Farms

Here are a few of the popular resources teachers are using to teach about lots of different types of farms:

- Agriculture in the Classroom

- Alligator farm–video

- Dairy Farm tour-video

- Egg farm–video

- Farm Games

- Farm Games–Boowa and Kwala

- Find a dog

- Fish Farm–video

- Harvest of History–bit older

- Llama farm—video

- Organic Farm–video

- Virtual Farm–4H

- Wind Farm–video

- Wind turbine farm–video

–image credit Deposit Photos

Share this:

7 Online Resources to Teach About Vehicles

Do your first graders love vehicles? Here are a few of the popular resources teachers are using to teach about them:

- Build a car–abcya Design your very own vehicle with ABCya’s Create a Car! Choose from cars, trucks, buses, and even construction vehicles. Customize your vehicle with different wheels, engines, and more. Enjoy the ride!

- Vehicle Puzzle–click and drag puzzle pieces into place for this picture

- Freight Train Cars–video about all the cars in the freight train from Railway Vehicles

- Patterns in Vehicles–learn about patterns in this video by recognizing them in a video

- Transportation matching–mix and match vehicle parts to make your own unique vehicle

- Transportation Sequence Games–a lesson plan about transportation (but it does require a BrainPop Jr subscription)

- Vehicles–a wide collection of coloring pages for many different vehicles

Do you have any I can add to the list?

–image credit Deposit Photos

Share this:

HS Financial Training Classes

Such an important topic, especially as we see kids aren’t graduating with basic knowledge of budgeting, paying bills, and more. CNBC has a great article on one of their blogs on this subject you’ll appreciate:

High schools, scrambling to prep Gen Z for the real world, are teaching students to make and manage money

We at Ask a Tech Teacher have written often about financial literacy. Check out these articles:

- April is Financial Literacy Month

- 7+ Websites to Teach Financial Literacy

- Financial Literacy Resources

Share this:

7+ Websites to Teach Financial Literacy

When kids read that America’s $30 trillion+ debt is accepted by many experts as ‘business as usual’, I wonder how that news will affect their future personal finance decisions. Do they understand the consequences of unbalanced budgets? The quandary of infinite wants vs. finite dollars? Or do they think money grows on some fiscal tree that always blooms? The good news is: Half of the nation’s schools require a financial literacy course. The bad new is: Only half require a financial literacy course.

When kids read that America’s $30 trillion+ debt is accepted by many experts as ‘business as usual’, I wonder how that news will affect their future personal finance decisions. Do they understand the consequences of unbalanced budgets? The quandary of infinite wants vs. finite dollars? Or do they think money grows on some fiscal tree that always blooms? The good news is: Half of the nation’s schools require a financial literacy course. The bad new is: Only half require a financial literacy course.

I’ve noticed news stories about schools adding financial literacy to the High School course load (yay!). If your school doesn’t teach personal economics but would like to, there are many online sites that address the topic as mini-lessons. Some are narrative; others games. Here are some I like. See if one suits you:

Banzai

Banzai is a personal finance curriculum that teaches high school and middle school students how to prioritize spending decisions through real-life scenarios and choose-your-own adventure (kind of) role playing. Students start the course with a pre-test to determine a baseline for their financial literacy. They then engage in 32 life-based interactive scenarios covering everything from balancing a budget to adjusting for unexpected bills like car trouble or health problems. Once they’ve completed these exercises, they pretend that they have just graduated from high school, have a job, and must save $2,000 to start college. They are constantly tempted to mis-spend their limited income and then must face the consequences of those actions, basing decisions on what they learned in the 32 scenarios. Along the way, students juggle rent, gas, groceries, taxes, car payments, and life’s ever-present emergencies. At the end, they take a post-test to measure improvement in their financial literacy.

The program is free, takes about eight hours (depending upon the student), and can include printed materials as well as digital.

Share this:

15+ Websites to Teach Financial Literacy

Financial Literacy Month is recognized annually in Canada in November,[1] and National Financial Literacy Month was recognized in the United States in April 2004,[2] in an effort to highlight the importance of financial literacy and teach citizens how to establish and maintain healthy financial habits.

Financial Literacy Month is recognized annually in Canada in November,[1] and National Financial Literacy Month was recognized in the United States in April 2004,[2] in an effort to highlight the importance of financial literacy and teach citizens how to establish and maintain healthy financial habits.

When kids read that America’s $28 trillion+ debt is accepted by many experts as ‘business as usual’, I wonder how that news will affect their future personal finance decisions. Do they understand the consequences of unbalanced budgets? The quandary of infinite wants vs. finite dollars? Or do they think money grows on some fiscal tree that always blooms? The good news is: Half of the nation’s schools require a financial literacy course. The bad new is: Only half require a financial literacy course.

If your school doesn’t teach a course about personal economics, there are many online sites that address the topic as mini-lessons. Some are narrative; others games. Here are fifteen I like. See if one suits you (check here for updates on links):

- Banzai–financial literacy (free) online program

- Bartleby Economics Q&A

- BizKids–games to teach business and finance

- Budget Challenge–for HS and college

- Cash Crunch–games for youngers and olders (HS and college)

- Financial Football–as fun as it sounds

- Financial Literacy Quizzes–in a variety of financial topics for high schoolers

- Gen I Revolution

- H&R Block Budget Challenge game

- Life on Minimum Wage (a game–through TpT but free)

- Living Wage–what’s it cost to survive–by state, cities, counties

- Own vs Rent Calculator–plug in the numbers; see the results

- Personal Finance for MS

- Personal Finance Lab–stock market game

- Practical Money Skills

- Spent

Curriculum

Share this:

15 Websites to Teach Financial Literacy

When kids read that America’s $23 trillion+ debt is accepted by many experts as ‘business as usual’, I wonder how that news will affect their future personal finance decisions. Do they understand the consequences of unbalanced budgets? The quandary of infinite wants vs. finite dollars? Or do they think money grows on some fiscal tree that always blooms? The good news is: Half of the nation’s schools require a financial literacy course. The bad new is: Only half require a financial literacy course.

When kids read that America’s $23 trillion+ debt is accepted by many experts as ‘business as usual’, I wonder how that news will affect their future personal finance decisions. Do they understand the consequences of unbalanced budgets? The quandary of infinite wants vs. finite dollars? Or do they think money grows on some fiscal tree that always blooms? The good news is: Half of the nation’s schools require a financial literacy course. The bad new is: Only half require a financial literacy course.

If your school doesn’t teach a course about personal economics, there are many online sites that address the topic as mini-lessons. Some are narrative; others games. Here are fifteen I like. See if one suits you:

Admongo

Age group: Middle school

Through this interactive video game, students learn to identify advertising and understand its messages with the goal of becoming informed, discerning consumers. To win the game, they will have to answer questions like, “Who is responsible for the ad?”, “What is the ad actually saying?”, and “What does the ad want me to do?” For educators and parents, Admongo includes tools like videos, lesson plans, printed materials, downloads, and alignment with state standards.

Admongo is put out by the Federal Trade Commission who also offers another well-received game, “Spam Scam Slam” about spam.

Banzai

Age group: middle and high school

Banzai is a personal finance curriculum that teaches high school and middle school students how to prioritize spending decisions through real-life scenarios and choose-

your-own adventure (kind of) role playing. Students start the course with a pre-test to determine a baseline for their financial literacy. They then engage in 32 life-based interactive scenarios covering everything from balancing a budget to adjusting for unexpected bills like car trouble or health problems. Once they’ve completed these exercises, they pretend that they have just graduated from high school, have a job, and must save $2,000 to start college. They are constantly tempted to mis-spend their limited income and then must face the consequences of those actions, basing decisions on what they learned in the 32 scenarios. Along the way, students juggle rent, gas, groceries, taxes, car payments, and life’s ever-present emergencies. At the end, they take a post-test to measure improvement in their financial literacy.

The program is free, takes about eight hours (depending upon the student), and can include printed materials as well as digital.